JNJ Major Position Closed, Stock Price Reversed Upward (Reviewing the Entire Buy Low, Sell High Process)

JNJ's recent trading process was quite successful, and it can be summarized in three stages.

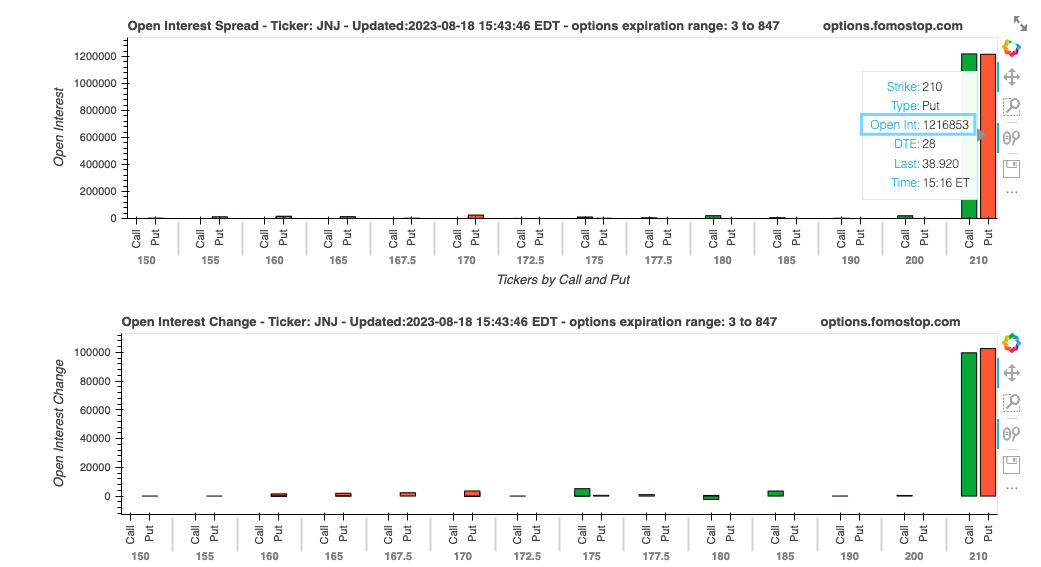

Stage One: Upon discovering that FLowmaster data was showing a significant bias towards bearish straddle positions, I began researching and decided to buy bearish positions. (On that day, JNJ was around $172. I purchased the 165 Put option with an expiration date of September 8, taking into account FLowmaster's positions as their DTE was 28.)

Data One: Link to Data

The data for continuous additions reached an astonishing 1.2 million on August 18.

JNJ's recent trading process was quite successful, and it can be summarized in three stages.

Stage One: Upon discovering that FLowmaster data was showing a significant bias towards bearish straddle positions, I began researching and decided to buy bearish positions. (On that day, JNJ was around $172. I purchased the 165 Put option with an expiration date of September 8, taking into account FLowmaster's positions as their DTE was 28.)

Data One: Link to Data

The data for continuous additions reached an astonishing 1.2 million on August 18.

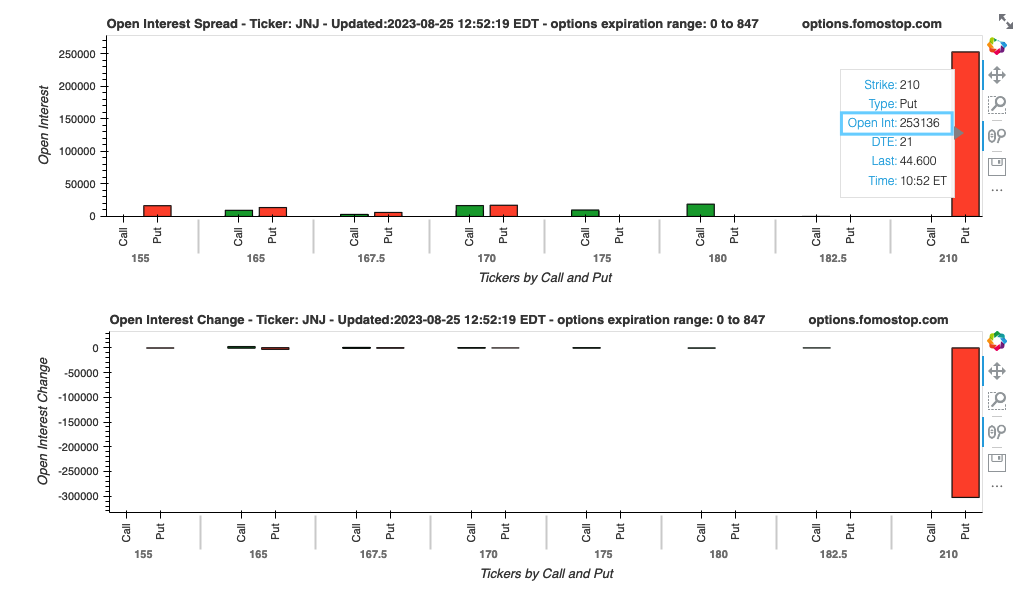

Stage Two: I smoothly entered the critical zone of the trade and continued monitoring the data. I observed the first instance of closing positions and started considering when to exit:

Data Two: Link to Data

Stage Three: After doubling the profits, I continued to observe. FLowmaster's data consistently showed ongoing position closures, leading to a reduction of over half of the major position. Combining this with data from KVUE, I noticed signs of a change in direction indicating a shift towards a bullish outlook.

Data Three: Link to Data

I decided to exit and take profits during this timeframe:

Data Four: Link to Data

This complete trading wave spanned 14 days, relying entirely on Flowmaster's analytical data. During this period, JNJ's movements were largely independent of the broader market. For example, when the market experienced a sharp decline yesterday, JNJ remained relatively unaffected because it follows its own trajectory based on the underlying data. This is a record by Flowmaster aimed at sharing data analysis experiences with others for learning purposes. Feel free to continue discussions and learning within the group.

Summary:

Data has a predictive role. We can see the process of inflow and accumulation during this wave. Currently, the position has almost been entirely closed. Therefore, the optimal time to exit is when the selling volume has decreased by more than half. It's better to earn a little less than to be slower than them. Lastly, here is the final data for today. Oh yeah, FOMOSTOP.